工廠(chǎng)參觀(guān)MORE >>

工廠(chǎng)參觀(guān)MORE >>

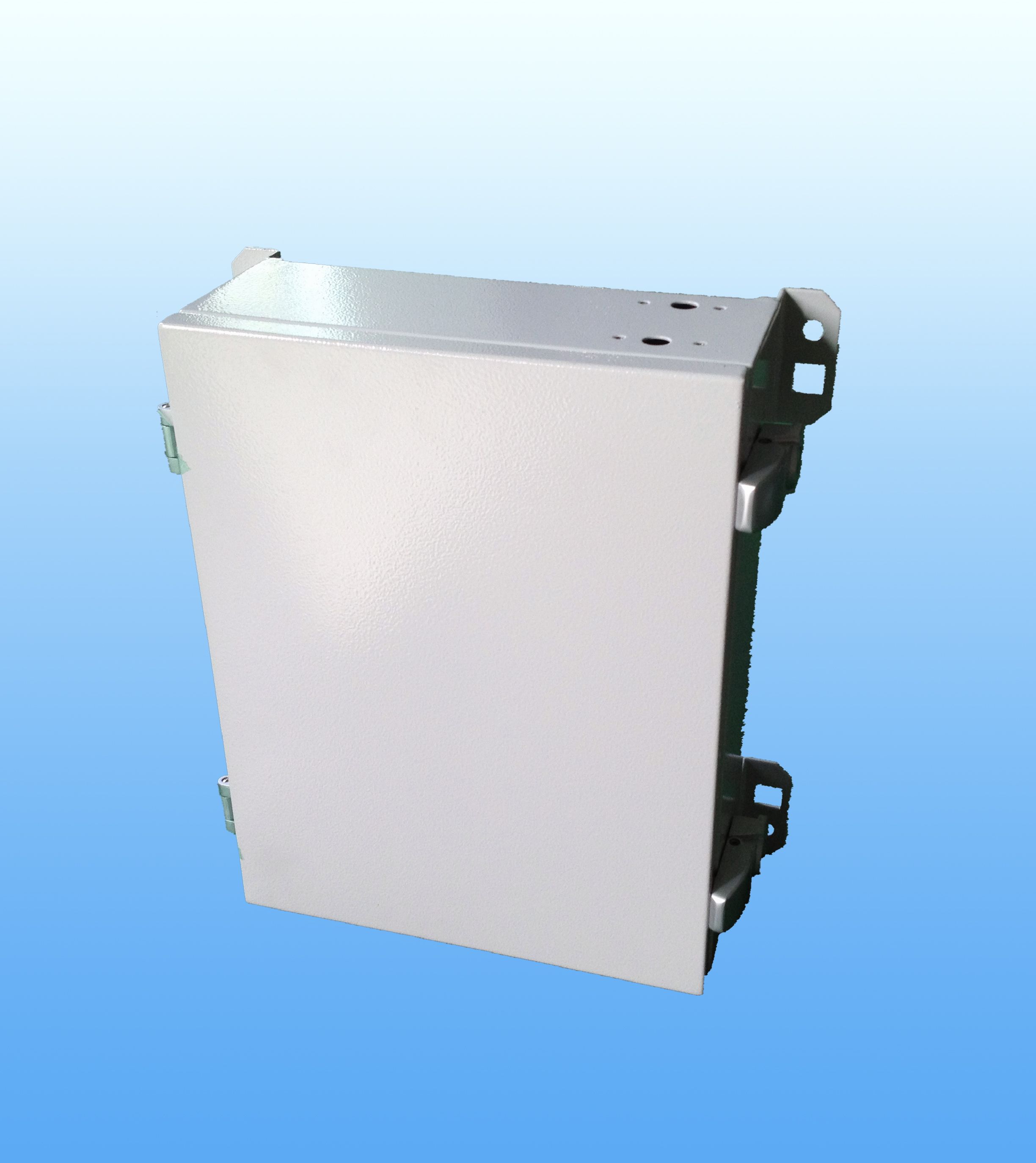

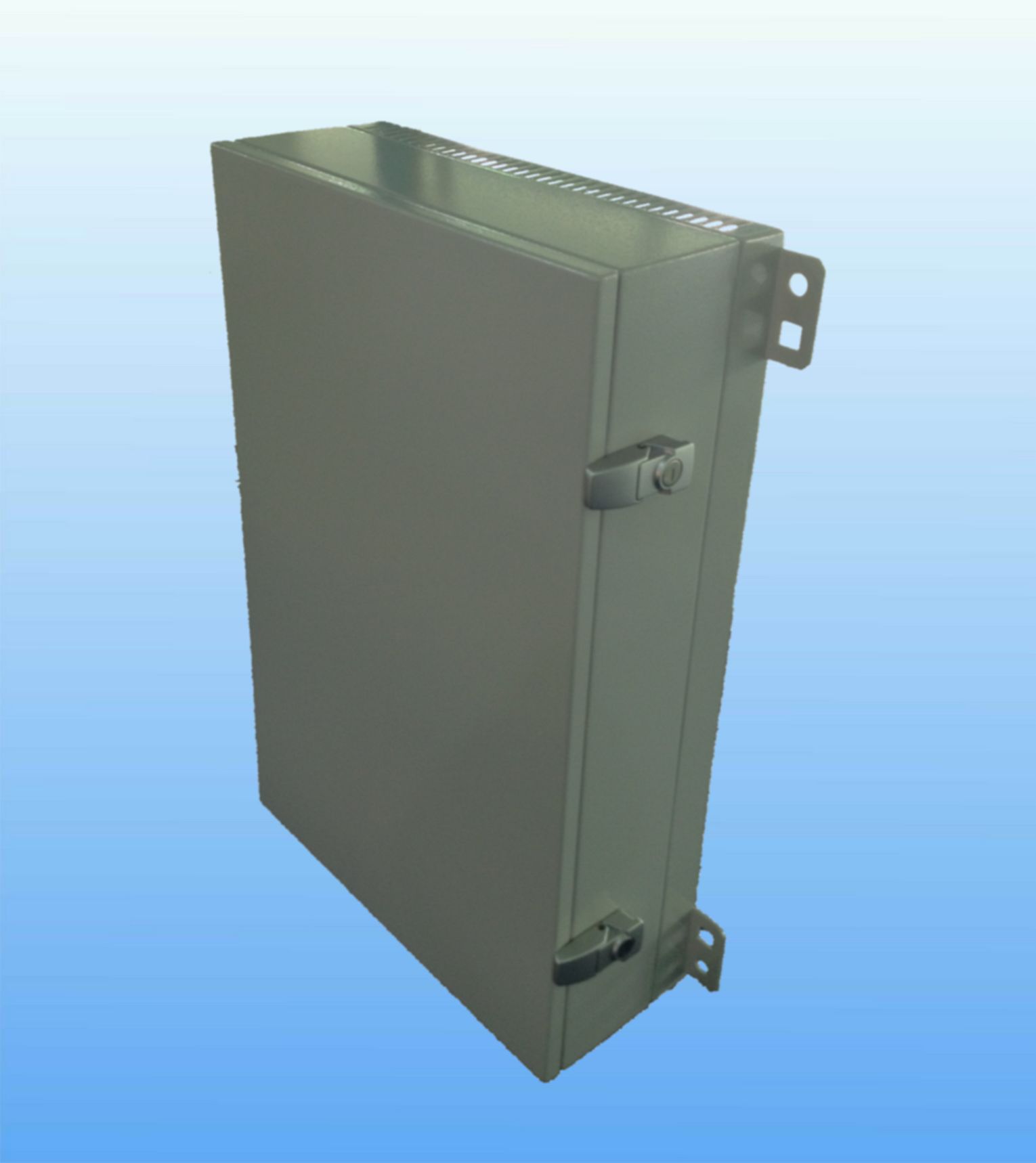

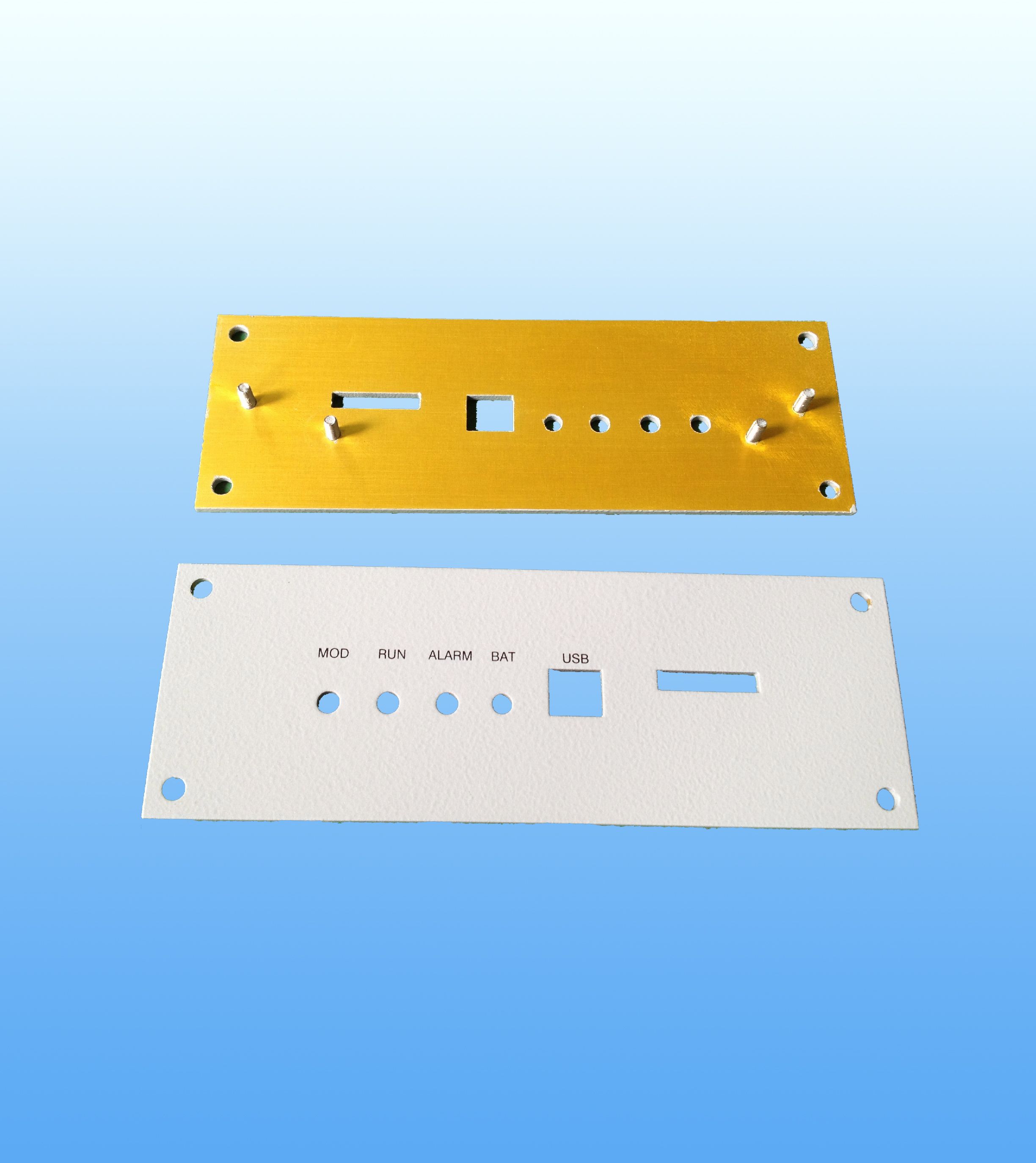

工廠(chǎng)參觀(guān)

工廠(chǎng)參觀(guān)

最新消息MORE >>

最新消息MORE >>

最新消息

最新消息

榮譽(yù)MORE >>

榮譽(yù)MORE >>

榮譽(yù)

榮譽(yù)

招聘MORE >>

招聘MORE >>

招聘

招聘- 點(diǎn)擊查看折彎師傅

- 點(diǎn)擊查看焊接技工

- 點(diǎn)擊查看打磨技工

- 點(diǎn)擊查看裝配師傅

- 點(diǎn)擊查看數(shù)沖操機(jī)員

- 點(diǎn)擊查看鈑金工程師